Free help available through tax maze

Last updated 3/11/2014 at Noon

Tic toc. Tic toc.

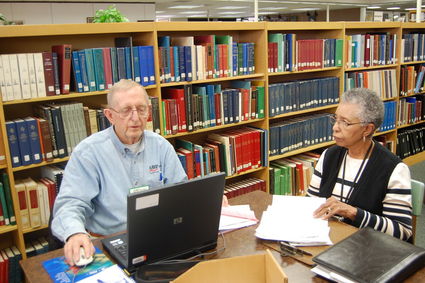

Time is running out. It will be April 15 before procrastinating taxpayers will know it. For those who haven’t filed yet, or who need assistance, there’s some free help out there in completing your taxes before the deadline. AARP is offering free tax filing assistance from 12:15 p.m. to 4 p.m. every Wednesday and Friday until April 11 and April 15 at the Orange Public Library. Trained volunteers will be available during those hours.

Electronic filing will also be available. No tax returns will be started after 4 p.m.

Dick Porter with AARP said the majority of the tax counseling is for elderly residents, but they also assist low income residents with their taxes.

“We’ll take anyone who comes in,” Porter said. “The program is demand-driven and by need.”

Anyone seeking assistance should bring the following:

All W-2 and 1-00 Forms including Social Security benefits statements.

Records of capital gains and losses.

Receipts of medical expenses, taxes paid, interest paid, contributions, casualty and theft losses, job expenses, sales tax receipts for major purchases and Social Security cards for dependents.

Also, a copy of the 2012 tax return is very helpful to volunteers assisting in the preparation of the 2013 return.

Porter has been involved with AARP tax assistance since 1994. He said it started long before that when Reese Littlefield founded the program. The tax return preparation takes about 30 minutes to complete. Often taxpayers would have to pay back much more to the IRS if it wasn’t for the AARP assistance.

“The system is complicated enough. We do an accurate tax return and get the refund the taxpayer is entitled to,” he said.

All volunteers are trained and certified by AARP. They are also trained under the IRS’s Link and Learn training instructional program and they must pass a competency test every year.

“I want to say kudos to the volunteers,” Porter said. “We could always use more next year.”

The AARP crew at Orange consists of five counselors, a quality review person and two client facilitators who schedule appointments. The AARP organization in this area falls under the greater Houston umbrella.

Other free tax help in addition to the AARP is at the Jackson Community Center at 520 W. Decatur Avenue in Orange. Families earning up to $50,000 are eligible for assistance.

Executive director Elizabeth Campbell said the assistance is done through appointments only during the hours of 10 a.m. to 1 p.m. on Saturdays and will last until April 14. They also prepare electronic filing.

Campbell asks taxpayers to bring Forms W-2 and a 1099statement of earning, driver’s license, Social Security card, dependent’s Social Security card, property tax statements and interest paid on properties in a 1098 Form and a tax identification number and military identification. Both parties must be present also if filing jointly.

All volunteers are trained under the VITA program- Volunteer Income Tax Training Assistance from the IRS in Beaumont. Some of the volunteers also have previous tax training.

Jackson Community Center also offers financial education and services to residents. The program is sponsored by the Community Outreach Program of Lamar University, Entergy Texas and the Jackson Community Center.

In addition to the W. Decatur Avenue location, other locations include James Zay Plaza, 610 Burton Avenue in Orange, from 10 a.m. to 4 p.m. on Tuesdays; Orange Navy Homes, 1885 Farragut Avenue in Orange, 10 a.m. to 4 p.m. on Wednesdays and Cypresswood Crossing, 1010 Highway 87 in Orange, 10 a.m. to 4 p.m. on Thursdays.

To schedule an appointment and for additional information, contact Elizabeth Campbell at 409-779-1981 or e-mail at [email protected].

Reader Comments(0)